Monday Night Football has evolved from an American television tradition into a global phenomenon, captivating audiences far beyond the United States. In the UK, the programme has witnessed unprecedented growth, transforming from a niche interest into mainstream entertainment that regularly draws millions of British viewers.

Record-Breaking Viewership Signals Growing Appeal

The 2025 NFL season has commenced with remarkable viewing figures that underscore the sport’s expanding popularity. Monday Night Football’s season opener between the Minnesota Vikings and Chicago Bears attracted 22.1 million viewers across all platforms, representing an 8% increase from the previous year’s inaugural game. This milestone marks ESPN’s second most-watched season debut since acquiring Monday Night Football rights in 2006.

The growth trajectory has been consistent and impressive. ESPN’s coverage has reached nearly 100 million fans in under two months during the first half of the season, with Monday Night Football averaging 14.4 million viewers through 11 games. This performance joins the 2023 campaign as the programme’s two highest audiences at this point in the season since 2010.

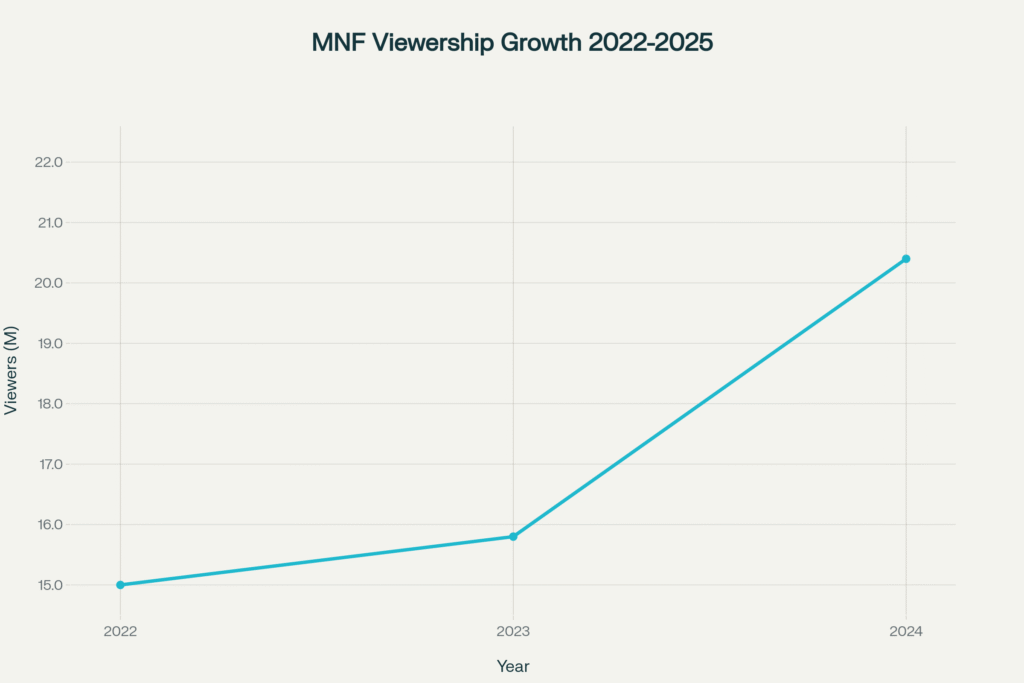

Monday Night Football viewership has shown consistent growth, reaching 22.1 million viewers in the 2025 season opener

UK Broadcasting Revolution Transforms Access

British audiences have witnessed a broadcasting revolution that has dramatically expanded access to NFL content. Sky Sports has secured a landmark three-year deal with the NFL, extending their partnership beyond 30 years and increasing live coverage by nearly 50%. The agreement provides Sky with first-pick exclusive games on Sunday at 6pm and 9pm, alongside additional concurrent games.

Channel 5 has emerged as a game-changer for UK NFL coverage, launching a groundbreaking free-to-air partnership. The Paramount-owned broadcaster now shows two live NFL games weekly, with coverage at 6pm on the main channel and 9pm on 5Action, rebranded as ‘5NFL’ on game nights. This expansion includes the Super Bowl, London games, Thanksgiving specials, and three playoff matches.

The expanded coverage means UK fans now have access to approximately 160 NFL games per season through Sky Sports, whilst Channel 5’s free-to-air coverage ensures the sport reaches new audiences without subscription barriers.

Super Bowl Success Demonstrates UK Appetite

Super Bowl viewership in the UK has reached record-breaking levels, demonstrating the sport’s mainstream appeal. Super Bowl LVIII delivered a combined 3.4 million unique viewers across Sky Sports and ITV, representing a 48% year-on-year increase. Sky Sports alone peaked at 761,000 viewers, marking a 35% increase on their previous single-game record.

The Taylor Swift effect proved particularly significant, with female viewership increasing by 100,000 viewers, representing a 93% rise. This demographic shift highlights the NFL’s expanding appeal beyond traditional sports audiences, with research showing 54% of British Taylor Swift fans planned to watch the Super Bowl.

Social media engagement has paralleled television growth, with NFL UK channels delivering 1.7 million engagements during Super Bowl week, representing a 130% year-on-year increase. Video views reached 23.6 million, whilst Sky Sports NFL’s social accounts generated 7.6 million impressions, up 145% from the previous year.

London Games Cement UK’s NFL Status

The NFL International Series has played a pivotal role in establishing the UK as American football’s European stronghold. Since the inaugural London game in 2007, the city has hosted 40 regular-season matches, with 25 of the 28 games achieving attendance figures exceeding 83,000.

The 2025 season features three London games across October at Tottenham Hotspur Stadium and Wembley. The Minnesota Vikings face the Cleveland Browns on 5 October, followed by the Denver Broncos against the New York Jets on 12 October, and concluding with the Los Angeles Rams versus Jacksonville Jaguars on 19 October.

Dublin joins the international expansion with its first regular-season NFL game, as the Pittsburgh Steelers meet the Minnesota Vikings at Croke Park. This historic match reflects the NFL’s commitment to European growth, with games also scheduled for Berlin, Madrid, and São Paulo.

Fan Demographics Reveal Changing Landscape

Research indicates that 13 million UK residents now identify as NFL fans, representing a 20% increase over the past decade. The demographic profile shows 73% of British NFL fans are male, with the 30-50 age group representing 39% of the fanbase. However, younger demographics are showing increased engagement, particularly through social media platforms.

The NFL’s appeal in the UK significantly outpaces other American sports, with 9% of Britons expressing interest compared to 4% for the NBA, MLB, and NHL respectively. This preference positions American football as the most popular US sport among British audiences.

Tom Brady remains the most recognisable NFL player among UK fans, with 12% citing him as a favourite. Patrick Mahomes follows at 9%, alongside established names like Rob Gronkowski and Aaron Rodgers. This star power contributes significantly to the sport’s marketing appeal and broadcast value.

Economic Impact Drives Investment

The NFL’s UK presence generates substantial economic benefits, with projections suggesting a permanent London franchise could contribute £1.2 billion in cumulative economic output by 2029. Current London games attract international visitors, with 45% of attendees travelling from outside the UK, creating significant tourism revenue.

Broadcast rights deals reflect this economic potential. Sky Sports’ new agreement reportedly costs significantly more than previous arrangements, whilst ESPN’s Monday Night Football rights deal with the NFL averages £2.7 billion annually through 2032. These investments demonstrate broadcaster confidence in sustained audience growth.

The introduction of Channel 5’s free-to-air coverage represents a strategic investment in market expansion. By removing subscription barriers, the broadcaster aims to cultivate new audiences who may subsequently subscribe to premium services.

Social Media Strategy Fuels Growth

The NFL’s “helmets off” social media approach has proven particularly effective in the UK market. This strategy focuses on players’ personal stories and interests rather than purely game-related content, creating deeper fan connections. With only 17 regular-season games compared to other sports’ extensive schedules, this approach maximises engagement opportunities.

NFL social media accounts across all 32 teams collectively reach 153.2 million followers globally, with significant UK engagement. Content tied to London games generates over 120 million annual impressions, whilst fantasy football discussions have increased 70% year-on-year.

The league’s TikTok strategy has proved particularly successful, with 45% of NFL UK’s 231 million tournament views during major events originating from the platform. Crucially, 76% of the NFL’s UK social media audience is under 34 years old, indicating strong future growth potential.

Monday Night Football’s Prime-Time Appeal

Monday Night Football’s UK success reflects broader NFL growth patterns. The programme consistently delivers premium audiences for broadcasters, with Sky Sports regularly featuring Monday night games as part of their comprehensive coverage package. The show’s format, combining live action with expert analysis, has proven particularly appealing to British viewers accustomed to similar football programming structures.

The programme’s success has encouraged additional Monday night content, with ESPN’s Monday Night Countdown pregame show achieving 1.76 million viewers for the 2025 season opener, representing a 39% increase from the previous year. This growth indicates appetite for comprehensive NFL coverage beyond live games.

Celebrity involvement has enhanced Monday Night Football’s appeal, with Taylor Swift’s relationship with Travis Kelce generating significant additional interest. The Manchester United vs. Liverpool match on Sky Sports’ Monday Night Football programme previously achieved 3.57 million viewers, demonstrating the time slot’s potential for premium sporting events.

Technology and Innovation Drive Engagement

Nielsen’s new “Big Data + Panel” measurement system has revealed more accurate viewership figures, consistently showing higher audiences than previous methodologies. This enhanced measurement combines traditional panel data with millions of set-top box and smart TV data points, providing comprehensive audience insights.

The NFL has embraced innovative broadcast formats, including the popular ManningCast alternative commentary featuring Peyton and Eli Manning. These viewing options cater to diverse audience preferences whilst maintaining core game coverage.

Sky Sports’ dedicated NFL channel, launched in 2020, provides round-the-clock coverage throughout the season. This investment demonstrates long-term commitment to the UK market whilst offering comprehensive content beyond live games.

Future Expansion and Investment

The NFL’s UK expansion shows no signs of slowing, with discussions surrounding a permanent London franchise gaining momentum. League executives project significant growth potential, with models suggesting substantial economic benefits from a UK-based team.

Broadcasting partnerships are evolving to meet growing demand. Sky Sports’ increased allocation to approximately 160 games per season reflects confidence in sustained audience growth, whilst Channel 5’s free-to-air coverage aims to develop new fan bases.

International games are expanding beyond London, with Dublin hosting its inaugural NFL game in 2025. This geographic expansion demonstrates the NFL’s commitment to European growth whilst providing new revenue opportunities.

Cultural Integration and Media Coverage

Monday Night Football has successfully integrated into UK sporting culture, with British media providing extensive coverage and analysis. The programme receives comparable attention to Premier League matches, reflecting its mainstream acceptance Notting Hill Carnival events and other major UK cultural moments.

The sport’s growing popularity has influenced other areas, with NFL-style entertainment formats appearing at various UK sporting events. Fantasy football participation has increased significantly, creating year-round engagement beyond the traditional September-February season.

Celebrity endorsements and media personalities have embraced the NFL, with figures like Dermot O’Leary, Sam Quek, and former player Osi Umenyiora fronting Channel 5’s coverage. This mainstream media integration helps legitimise the sport among broader UK audiences.

Challenges and Opportunities

Despite remarkable growth, challenges remain for NFL expansion in the UK. Time zone differences mean many games air during early morning hours, limiting casual viewership. However, prime-time slots for Monday Night Football and Sunday evening games have proven successful.

Competition from established sports, particularly football (soccer), presents ongoing challenges. However, the NFL’s entertainment-focused approach and limited game schedule create distinct positioning opportunities. The sport’s spectacle and production values differentiate it from traditional UK sports coverage.

Technological advances offer new opportunities for engagement. Streaming platforms, social media integration, and interactive content provide additional touchpoints for fan development. The NFL’s data-driven approach to content creation and distribution positions it well for continued UK growth.

Economic Implications for UK Sports Industry

The NFL’s success has broader implications for UK sports broadcasting and entertainment. Premium rights deals demonstrate the value of exclusive content, influencing negotiations across other sports properties. The success of free-to-air coverage on Channel 5 may encourage similar strategies for other international sports.

Local sports businesses benefit from increased American football interest, with equipment sales, coaching services, and youth programmes experiencing growth. The Manchester United and other UK football clubs have observed NFL strategies for fan engagement and commercial activities.

Tourism benefits extend beyond game days, with NFL-themed attractions and experiences becoming popular year-round activities. London’s status as an international NFL destination enhances the city’s sporting reputation alongside traditional events.

Broadcasting Innovation Sets New Standards

The NFL’s UK broadcasting approach has influenced sports coverage standards across the industry. Multi-platform distribution, alternative commentary options, and comprehensive social media integration have become benchmarks for premium sports content.

Production values for NFL coverage consistently exceed traditional UK sports broadcasting standards, utilising advanced graphics, statistical integration, and entertainment elements. These innovations have raised viewer expectations across all sports programming.

The success of personality-driven coverage, exemplified by Channel 5’s entertainment-focused approach, demonstrates audience appetite for accessible sports presentation. This format innovation may influence coverage of other complex sports requiring explanation for new audiences.

Monday Night Football’s transformation from American television staple to UK mainstream entertainment represents a remarkable success story. Through strategic broadcasting partnerships, innovative presentation, and consistent quality, the NFL has established itself as essential viewing for millions of British fans.

The sport’s growth trajectory shows no signs of slowing, with expanded coverage, new venues, and evolving demographics indicating continued expansion. As the NFL approaches its fourth decade of UK presence, Monday Night Football stands as testament to sport’s power to transcend cultural boundaries and create new traditions.

The programme’s success reflects broader changes in UK media consumption, international sport popularity, and entertainment expectations. For broadcasters, advertisers, and sports organisations, the NFL’s UK journey provides valuable insights into building sustainable international audiences in competitive media landscapes.

Frequently Asked Questions

What time does Monday Night Football air in the UK?

Monday Night Football typically begins at 1:15am GMT on Tuesday morning due to the time difference between the US and UK. Sky Sports provides comprehensive coverage including pre-game analysis and post-game highlights.

Where can I watch Monday Night Football in the UK?

Monday Night Football is available on Sky Sports NFL, with some games simulcast on ESPN if you have access through streaming services. NFL Game Pass via DAZN also provides comprehensive coverage of all NFL games.

How popular is the NFL in the UK compared to other American sports?

The NFL is significantly more popular than other American sports in the UK, with 9% of Britons expressing interest compared to just 4% for the NBA, MLB, and NHL respectively. This makes American football the most popular US sport among British audiences.

Are there any NFL games played in the UK?

Yes, London hosts three NFL regular-season games annually at Wembley Stadium and Tottenham Hotspur Stadium. In 2025, Dublin will also host its first NFL game. These international games typically sell out quickly and attract over 80,000 fans each.

How has NFL viewership grown in the UK recently?

NFL UK viewership has experienced remarkable growth, with Super Bowl audiences increasing by 48% year-on-year to 3.4 million viewers in 2024. Sky Sports reported record-breaking figures, whilst social media engagement increased by 130% during major events.

For sports fans and cultural enthusiasts looking for more insights into UK entertainment and sporting trends, including coverage of major events like the Ellie Kildunne phenomenon in rugby, comprehensive analysis continues to shape understanding of Britain’s evolving sporting landscape.

To Read More – London City News